|

||||||||||

| PREV CLASS NEXT CLASS | FRAMES NO FRAMES | |||||||||

| SUMMARY: NESTED | FIELD | CONSTR | METHOD | DETAIL: FIELD | CONSTR | METHOD | |||||||||

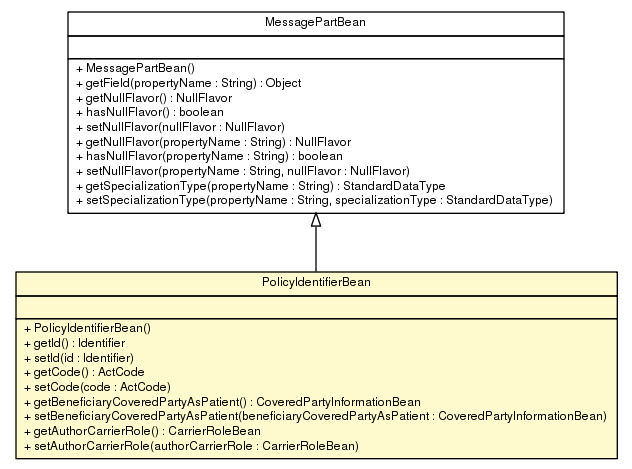

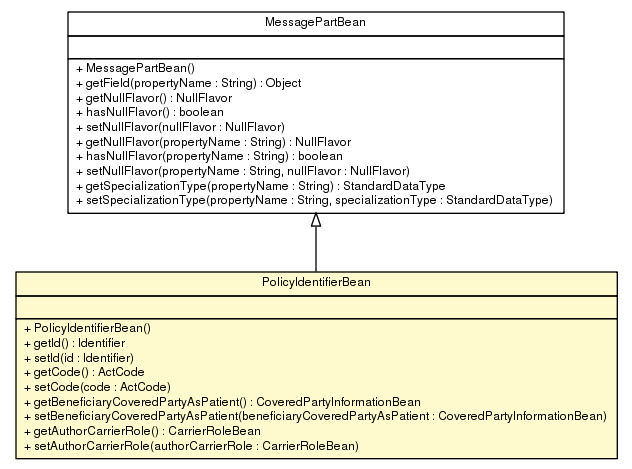

java.lang.Objectca.infoway.messagebuilder.model.MessagePartBean

ca.infoway.messagebuilder.model.pcs_mr2007_v02_r01.claims.merged.PolicyIdentifierBean

public class PolicyIdentifierBean

Business Name: PolicyIdentifier

FICR_MT600201CA.PolicyOrAccount: Policy Identifier

id: = Coverage Identifier, extension = Policy.Plan.Group.Contract. Division.Section.Version (or similar). Carrier noted in author participation, and may not be same namespace as OID of id

| Constructor Summary | |

|---|---|

PolicyIdentifierBean()

|

|

| Method Summary | |

|---|---|

CarrierRoleBean |

getAuthorCarrierRole()

Un-merged Business Name: (no business name specified) |

CoveredPartyInformationBean |

getBeneficiaryCoveredPartyAsPatient()

Un-merged Business Name: (no business name specified) |

ActCode |

getCode()

Business Name: PolicyType |

Identifier |

getId()

Un-merged Business Name: PolicyID |

void |

setAuthorCarrierRole(CarrierRoleBean authorCarrierRole)

Un-merged Business Name: (no business name specified) |

void |

setBeneficiaryCoveredPartyAsPatient(CoveredPartyInformationBean beneficiaryCoveredPartyAsPatient)

Un-merged Business Name: (no business name specified) |

void |

setCode(ActCode code)

Business Name: PolicyType |

void |

setId(Identifier id)

Un-merged Business Name: PolicyID |

| Methods inherited from class ca.infoway.messagebuilder.model.MessagePartBean |

|---|

getField, getNullFlavor, getNullFlavor, getSpecializationType, hasNullFlavor, hasNullFlavor, setNullFlavor, setNullFlavor, setSpecializationType |

| Methods inherited from class java.lang.Object |

|---|

clone, equals, finalize, getClass, hashCode, notify, notifyAll, toString, wait, wait, wait |

| Constructor Detail |

|---|

public PolicyIdentifierBean()

| Method Detail |

|---|

public Identifier getId()

Un-merged Business Name: PolicyID

Relationship: FICR_MT600201CA.PolicyOrAccount.id

Conformance/Cardinality: POPULATED (1)

In some cases, the policy identifier may include a concatenation of group, section, certificate, etc. to be unique. Methods for specifying the Extension component of the data type will be expressed in the NeCST Message Specifications.

For Worker's Compensation and Auto Invoices, the policy identifier (WCB or Auto Claim Number) may not be known when the Invoice is submitted. In these situations, the Adjudicator may require name, address and date of accident (for example) in the Invoice to help determine the WCB or Auto Claim Number (policy identifier). Most of these adjudicators will keep this Invoice Grouping pended until the WCB or Auto Claim Number (policy identifier) is found and may be refused after a specified time period (e.g. 10 days).

For Invoice: In good faith Invoices, the Policy Identifier, Covered Party Identifier and Policy Holder Identifier is not present, and therefore this attribute cannot be made mandatory.

For Invoice, Pre-Determination and Coverage Extension requests: If this information is not supplied, the Adjudicator may attempt to determine the information from other patient information supplied in the message (e.g. name, date of birth, gender) and would return this information with the response. If this cannot be obtained in a real time environment, the message may be rejected, depending on the Application Role (if Application Role = Final).

For Invoice, Pre-Determination and Coverage Extension results: This information is mandatory.

RxS1: This information is mandatory. Scheme to be confirmed.

Set of identifiers that uniquely identify the policy. I.e. WCB Number, Auto Number, Certificate Number, combined identifier (Group+Section+Coverage Number)

Un-merged Business Name: PolicyIdentifierS

Relationship: FICR_MT610201CA.PolicyOrAccount.id

Conformance/Cardinality: POPULATED (1)

identifier may include a concatenation of group, section, certificate, etc. to be unique. Methods for specifying the Extension component of the data type will be expressed in the NeCST Message Specifications.

For Worker's Compensation and Auto Invoices, the policy identifier (WCB or Auto Claim Number) may not be known when the Invoice is submitted. In these situations, the Adjudicator may require name, address and date of accident (for example) in the Invoice to help determine the WCB or Auto Claim Number (policy identifier). Most of these adjudicators will keep this Invoice Grouping pended until the WCB or Auto Claim Number (policy identifier) is found and may be refused after a specified time period (e.g. 10 days).

For Invoice: In good faith Invoices, the Policy Identifier, Covered Party Identifier and Policy Holder Identifier is not present, and therefore this attribute cannot be made mandatory.

For Invoice, Pre-Determination and Coverage Extension requests: If this information is not supplied, the Adjudicator may attempt to determine the information from other patient information supplied in the message (e.g. name, date of birth, gender) and would return this information with the response. If this cannot be obtained in a real time environment, the message may be rejected, depending on the Application Role (if Application Role = Final).

For Invoice, Pre-Determination and Coverage Extension results: This information is mandatory.

RxS1: This information is mandatory. Scheme to be confirmed.

Set of identifiers that uniquely identify the policy. I.e. WCB Number, Auto Number, Certificate Number, combined identifier (Group+Section+Coverage Number)

public void setId(Identifier id)

Un-merged Business Name: PolicyID

Relationship: FICR_MT600201CA.PolicyOrAccount.id

Conformance/Cardinality: POPULATED (1)

In some cases, the policy identifier may include a concatenation of group, section, certificate, etc. to be unique. Methods for specifying the Extension component of the data type will be expressed in the NeCST Message Specifications.

For Worker's Compensation and Auto Invoices, the policy identifier (WCB or Auto Claim Number) may not be known when the Invoice is submitted. In these situations, the Adjudicator may require name, address and date of accident (for example) in the Invoice to help determine the WCB or Auto Claim Number (policy identifier). Most of these adjudicators will keep this Invoice Grouping pended until the WCB or Auto Claim Number (policy identifier) is found and may be refused after a specified time period (e.g. 10 days).

For Invoice: In good faith Invoices, the Policy Identifier, Covered Party Identifier and Policy Holder Identifier is not present, and therefore this attribute cannot be made mandatory.

For Invoice, Pre-Determination and Coverage Extension requests: If this information is not supplied, the Adjudicator may attempt to determine the information from other patient information supplied in the message (e.g. name, date of birth, gender) and would return this information with the response. If this cannot be obtained in a real time environment, the message may be rejected, depending on the Application Role (if Application Role = Final).

For Invoice, Pre-Determination and Coverage Extension results: This information is mandatory.

RxS1: This information is mandatory. Scheme to be confirmed.

Set of identifiers that uniquely identify the policy. I.e. WCB Number, Auto Number, Certificate Number, combined identifier (Group+Section+Coverage Number)

Un-merged Business Name: PolicyIdentifierS

Relationship: FICR_MT610201CA.PolicyOrAccount.id

Conformance/Cardinality: POPULATED (1)

identifier may include a concatenation of group, section, certificate, etc. to be unique. Methods for specifying the Extension component of the data type will be expressed in the NeCST Message Specifications.

For Worker's Compensation and Auto Invoices, the policy identifier (WCB or Auto Claim Number) may not be known when the Invoice is submitted. In these situations, the Adjudicator may require name, address and date of accident (for example) in the Invoice to help determine the WCB or Auto Claim Number (policy identifier). Most of these adjudicators will keep this Invoice Grouping pended until the WCB or Auto Claim Number (policy identifier) is found and may be refused after a specified time period (e.g. 10 days).

For Invoice: In good faith Invoices, the Policy Identifier, Covered Party Identifier and Policy Holder Identifier is not present, and therefore this attribute cannot be made mandatory.

For Invoice, Pre-Determination and Coverage Extension requests: If this information is not supplied, the Adjudicator may attempt to determine the information from other patient information supplied in the message (e.g. name, date of birth, gender) and would return this information with the response. If this cannot be obtained in a real time environment, the message may be rejected, depending on the Application Role (if Application Role = Final).

For Invoice, Pre-Determination and Coverage Extension results: This information is mandatory.

RxS1: This information is mandatory. Scheme to be confirmed.

Set of identifiers that uniquely identify the policy. I.e. WCB Number, Auto Number, Certificate Number, combined identifier (Group+Section+Coverage Number)

public ActCode getCode()

Business Name: PolicyType

Un-merged Business Name: PolicyType

Relationship: FICR_MT610201CA.PolicyOrAccount.code

Conformance/Cardinality: OPTIONAL (0-1)

For Invoice: This information is likely not known or not required by a Payor. Will be required for HSA policies that use the same policy identifier as another policy.

For Adjudication Results: This could be mandatory to indicate the type of policy. Must be specified if the EOB references a policy that was not specified on the Invoice.

For Pre-Determination Results, this could be used to coordinate Pre-Determinations.

Policy Type - A code that identifies the type of coverage the policy provides. I.e.. H.S.A.

public void setCode(ActCode code)

Business Name: PolicyType

Un-merged Business Name: PolicyType

Relationship: FICR_MT610201CA.PolicyOrAccount.code

Conformance/Cardinality: OPTIONAL (0-1)

For Invoice: This information is likely not known or not required by a Payor. Will be required for HSA policies that use the same policy identifier as another policy.

For Adjudication Results: This could be mandatory to indicate the type of policy. Must be specified if the EOB references a policy that was not specified on the Invoice.

For Pre-Determination Results, this could be used to coordinate Pre-Determinations.

Policy Type - A code that identifies the type of coverage the policy provides. I.e.. H.S.A.

public CoveredPartyInformationBean getBeneficiaryCoveredPartyAsPatient()

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT600201CA.PolicyBeneficiary.coveredPartyAsPatient

Conformance/Cardinality: MANDATORY (1)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT610201CA.PolicyBeneficiary.coveredPartyAsPatient

Conformance/Cardinality: MANDATORY (1)

public void setBeneficiaryCoveredPartyAsPatient(CoveredPartyInformationBean beneficiaryCoveredPartyAsPatient)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT600201CA.PolicyBeneficiary.coveredPartyAsPatient

Conformance/Cardinality: MANDATORY (1)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT610201CA.PolicyBeneficiary.coveredPartyAsPatient

Conformance/Cardinality: MANDATORY (1)

public CarrierRoleBean getAuthorCarrierRole()

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT600201CA.PolicyUnderwriter.carrierRole

Conformance/Cardinality: POPULATED (1)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT610201CA.PolicyUnderwriter.carrierRole

Conformance/Cardinality: POPULATED (1)

public void setAuthorCarrierRole(CarrierRoleBean authorCarrierRole)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT600201CA.PolicyUnderwriter.carrierRole

Conformance/Cardinality: POPULATED (1)

Un-merged Business Name: (no business name specified)

Relationship: FICR_MT610201CA.PolicyUnderwriter.carrierRole

Conformance/Cardinality: POPULATED (1)

|

||||||||||

| PREV CLASS NEXT CLASS | FRAMES NO FRAMES | |||||||||

| SUMMARY: NESTED | FIELD | CONSTR | METHOD | DETAIL: FIELD | CONSTR | METHOD | |||||||||